The Overarching Problem with All OHM-Style DeFi Protocols

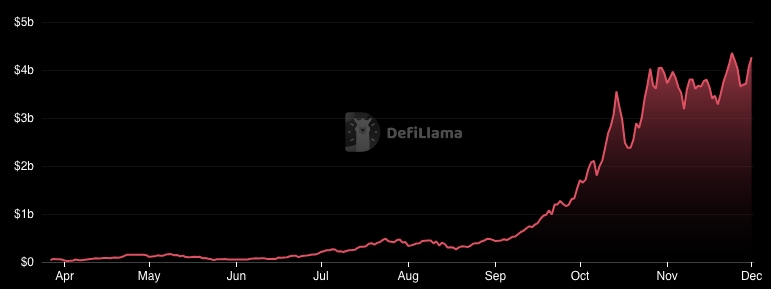

For those who don't know, OlympusDAO (ticker $OHM) was a DeFi protocol which took crypto by storm in 2021, reaching above a $4 billion USD valued market cap at it's very peak. The concept of OHM was revolutionary at the time, it was to build a protocol-owned treasury of well-established assets such as USDC and ETH, and back it's own native token (OHM) with these assets, while allowing the native token (OHM) to trade freely on the market.

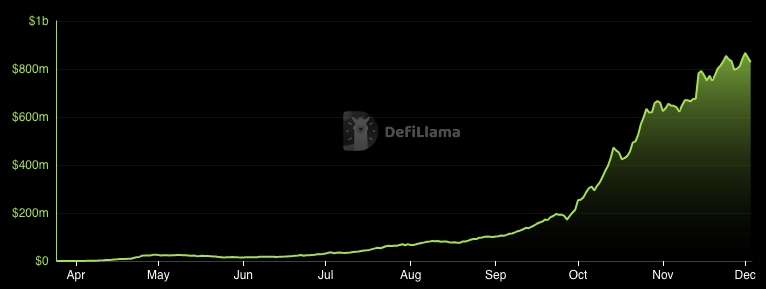

To grow the protocol-owned treasury, OlympusDAO used bonds. Bonds were essentially an offering of discounted, freshly minted $OHM tokens from the protocol itself in exchange for hard assets from the buyer (USDC, ETH, and more), then added to the protocol-owned treasury. Any $OHM purchased through bonds was vested for 5 days to prevent immediate arbitrage.

OlympusDAO also offered insanely high staking rewards for their native token, with APRs of percentages in the thousands. This drove excitement and heavy initial buy pressure, causing an incredible increase in $OHM's price, allowing them to sell bonds and build the protocol-owned treasury at an extreme rate.

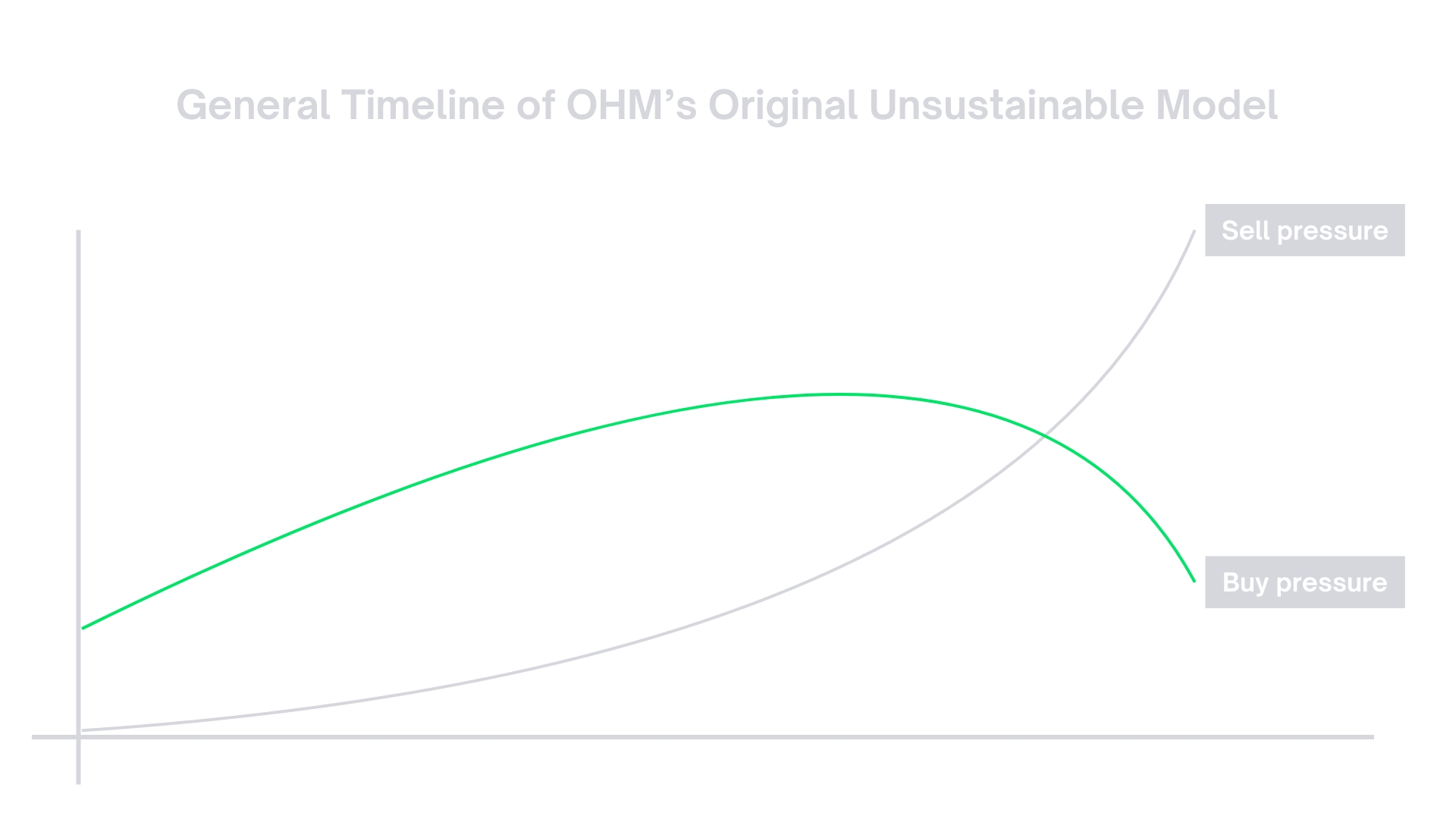

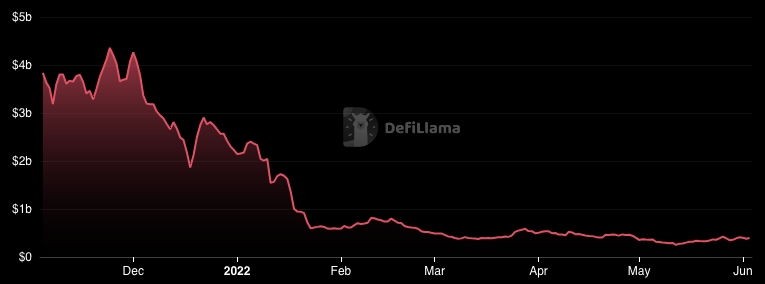

Eventually, the sell pressure from participants dumping their staking rewards outweighed the buy pressure. This led to $OHM eventually entering a huge death spiral after hitting an ATH of the previously mentioned $4 billion market cap.

In other words, there were so many participants already staked, earning yield, and selling off their earnings on the market, that the amount of new participants buying $OHM to stake was not able to outweigh this ever-increasing sell pressure.

The overarching problem with all OlympusDAO (OHM) style DeFi protocols lies in this inevitable death spiral caused by these factors. Many iterations and forks came after OlympusDAO, but were not successful in keeping their version sustainable.

What was concluded is that for an OHM-adjacent protocol to function sustainably, it needs to solve this issue of self reliance through revenue generation in a way that scales with the OHM model itself. It is not able to function endlessly from a stream of new investors and needed a scalable outside source of revenue to reach it's true potential.

Last updated